Table Of Content

Lastly, consulting a reputable realtor or real estate agent in your area is also a good option. A realtor can help assess the fair market value of your property in its current condition, and provide a reliable estimate of the annual appreciate rate in your suburb. Furthermore, you are also able to offset the amount of tax you pay with rental property specifically, if you exercise your right to deduct depreciation as an expense.

Annual home valueappreciation rate (R)

Ryan's journey reflects a blend of practical experience and entrepreneurial success, contributing to his role in developing a platform that educates and supports aspiring real estate professionals. He has dedicated his career to providing cutting-edge education and resources for real estate professionals. He emphasizes the importance of self-taught knowledge through mentors, books, and hands-on experience. The amount you can expect your home to appreciate depends on the above-mentioned factors and countless other micro- and macroeconomic indicators. In fact, the factors impacting home appreciation are so numerous and volatile that it’s unsafe for anyone to expect their home to appreciate.

Determine The Holding Period

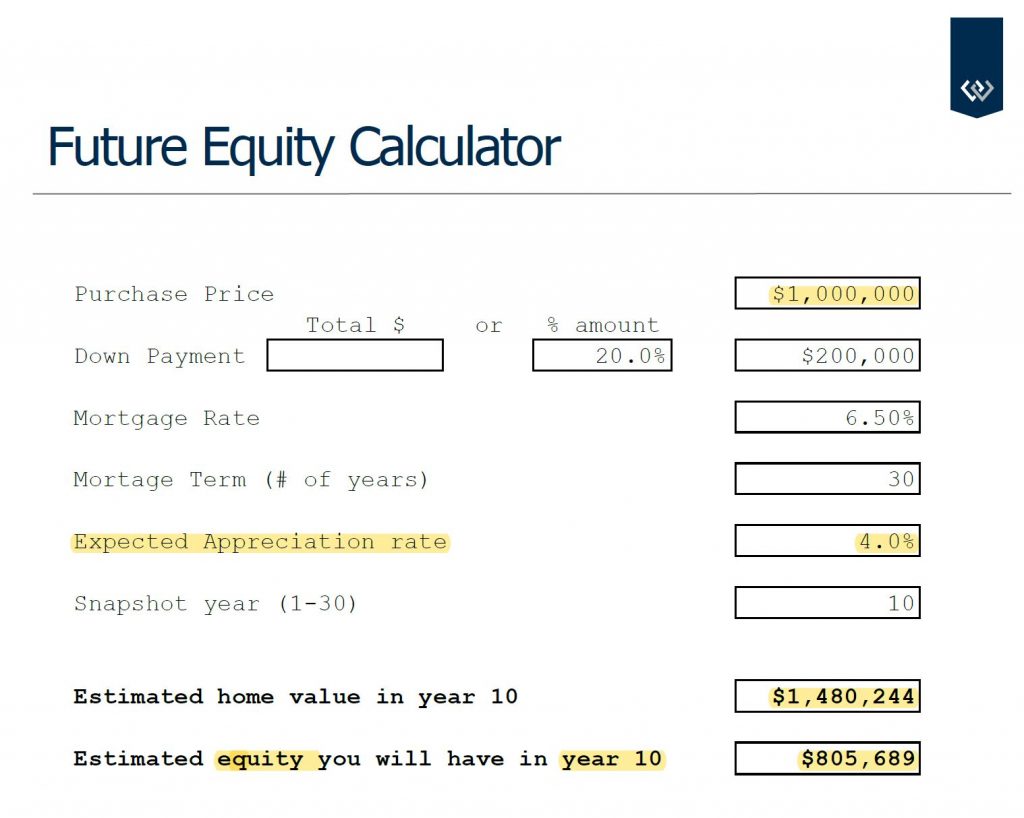

Average home appreciation rates are the rates at which homes increase in value for a given period of time. These rates will vary over time, but typically, they do not shoot up drastically. She’s considering buying a property for $300,000 in a neighborhood where homes have historically appreciated at a rate of 4% per year. Using a Home Appreciation Calculator, she finds that the property could be worth around $438,225 in 10 years.

Factors Influencing Home Appreciation

The typical down ranges between 5% to 20% of a home’s value, although you can put more, and in some cases, less. Purchase price refers to the price that you initially purchased your home for. This includes your down payment, plus the remaining amount that you might have financed through a lender. Is the house that you are looking to buy fit into the overall neighborhood? Does it have a special design or does it look similar to all the other houses on the block?

Home equity is the difference between what you owe on your mortgage and what your home is worth. It represents the dollar amount of your home that you actually own, and this money can be accessed and withdrawn through various loans and refinances should you ever need quick cash. Adding square footage is not the easiest way to add value to a home, but adding structures like a deck or a guest house will almost always add thousands of dollars in value to your home. The best way of doing this is by investing in your home and making improvements. Workout the potential profitability of an investment property with our Rental Property Calculator.

Using previous appreciation trends, appreciation calculators can make educated guesses about the value of your home. The median home value in the United States has experienced historic appreciation in as little as a few years. Since the pandemic shaped the current real estate market the median home value across the country has increased 2.6% year-over-year to $342,685, according to Zillow. There are several myths about home appreciation that can lead homeowners and investors astray. While homes generally appreciate over time, this isn’t always the case.

How Home Appreciation Contributes to Building Equity

How Much is My House Worth? Free Home Value Estimator - Zillow Research

How Much is My House Worth? Free Home Value Estimator.

Posted: Sat, 26 Nov 2016 00:26:02 GMT [source]

You might notice that adjusting the down payment percentage results in a different ROI percentage at the bottom of the tool. This calculator uses the “out-of-pocket method,” which is the preferred method of real estate investors. When you use this method, only your out-of-pocket expenses are considered when calculating your initial investment amount. The home appreciation rate varies from state to state, and city to city.

How we make money

Most often, down payments are calculated as a percentage of the purchase price of the home. Home Appreciation Calculator to estimate how much your house will be worth in the future. The House appreciation calculator uses the current home value and yearly appreciation rate to estimate the future house value. Ultimately it doesn’t make sense to use the simple interest formula for home appreciation. Doing so ignores the fact that the property has increased in value over the time period (assuming the interest rate is positive).

Simply enter the current value of the property, the home appreciation rate, and the number of years into the tool below. For example, let’s say your home was valued at $200,000 when you purchased it and that market value has increased to $225,000. This is a value increase of $25,000 but calculating the rate of appreciation requires a few more steps. Because the trend for homes in the United States is currently about 3-5% in appreciation, this means that most homeowners will see their home’s value increase in the long run. However, to maximize home appreciation, homeowners need to do their part. Once you’ve entered all the necessary information, click on the “Calculate” button to generate your results.

Of course, you don’t have to just sit back and passively hope for your home’s value to increase. You can actively help things along by undertaking home improvement projects that add value. By investing in projects that can increase your potential sale price, you can maximize your home’s appreciation.

The sensitive and responsive buttons facilitate quick and accurate data entry, reducing the likelihood of errors during calculations. Its sleek blue color adds a touch of modernity to your workspace, making it a stylish addition to any desk. Armed with these 3 pieces of information, you can work out the expected value of your home in 10 years. You simply need to enter these details into the home appreciation formula (see example further up the article) or use a home appreciation calculator. Looking for factors you can control that will increase a home’s value? Home improvements, upgrades and renovations are the most surefire way to encourage home appreciation.

Home appreciation is the rate at which the value of your home increases over time. It’s influenced by a variety of factors, from the condition of your home to the state of the real estate market. The great thing about home appreciation is that it can turn your home into a powerful investment tool, helping you build wealth over the long term.

No comments:

Post a Comment